Secure Your Future With a Green Card

Obtain your Green Card with Motcomb. Access the freedoms, education, and stability of American life for your family through institutional-grade investment projects.

Motcomb specializes in expedited and bespoke EB-5 solutions

Institutional Access for the Immigrant Investor

We provide access to securely structured private equity investments designed specifically for EB-5 applicants. Our focus is on capital preservation and immigration compliance, not speculative returns.

Aligned with Your Immigration Goals

We understand that every investor's timeline and risk tolerance is unique. Motcomb moves beyond the "one-size-fits-all" approach, offering projects from rural TEA developments to urban real estate, tailored to your specific residency and investment objectives.

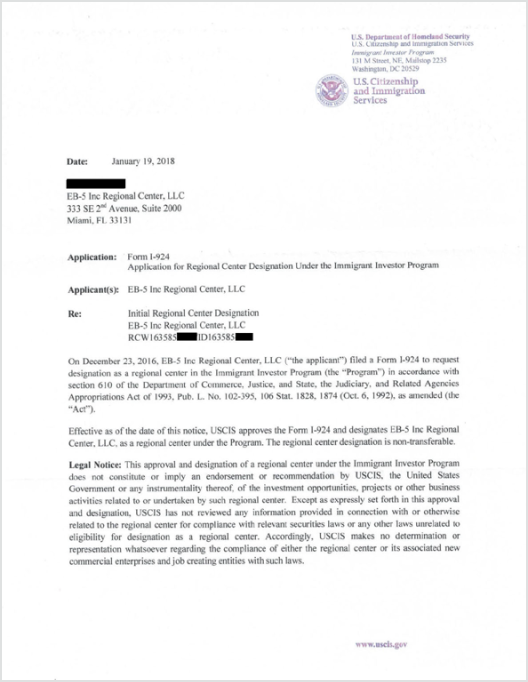

We’re Licensed and Have Dozens of Years of Experience

We are not a intermediaries. Motcomb operates as a licensed fund manager with direct oversight of our investment portfolios. This ensures accountability, transparency, and a direct line of communication throughout your investment lifecycle.

Rigorous Underwriting in High-Demand Sectors

We adopt an active selection process for EB-5 investments and dynamically manage our investment allocation across industry sectors. With particular focus on real estate and agribusiness.

Exclusive access to institutional-grade

EB-5 investments

More opportunities to become a U.S. Resident are comming soon

Join our newsletter to be the first to know about new programs

To learn more about how we care about your data, view our privacy policy.

Frequently asked questions

Here are some top questions about our citizenship and residency programs

Category 1

Financial & Capital Requirements

Answers to the most common questions around minimum investment amounts, total costs, and how Motcomb handles your capital.

Motcomb focuses on investment opportunities located in Targeted Employment Areas (TEAs), which currently qualify for the reduced investment threshold of $800,000, as mandated by the EB-5 Reform and Integrity Act of 2022. For non-TEA projects, the standard requirement is $1,050,000. Beyond the capital contribution, investors should anticipate administrative fees which we detail fully in our offering memorandum and legal and USCIS filing fees.

We accept capital from any lawful source, but verifying the "Source of Funds" is a critical part of the USCIS application. Whether your capital comes from business income, property sales, loans, or gifts, Motcomb works alongside your immigration counsel to ensure the documentation meets strict U.S. regulatory standards before your subscription is finalized.

Category 2

Risk Management & Security

Recurring questions about capital safety, potential returns, and how Motcomb vets every project it brings to investors.

While USCIS regulations require all EB-5 capital to be "at risk" (meaning no guarantees can be made), Motcomb prioritizes capital preservation. We focus on institutional-grade asset classes, primarily real estate and infrastructure, and typically structure our funds with senior loan positions or preferred equity. This approach aims to place our investors in a priority position for repayment upon the maturity of the investment, called the "waterfall".

Unlike intermediaries who list third-party projects, Motcomb acts as a direct fund manager. We employ an institutional underwriting process that evaluates developer track record, market feasibility, and exit strategy clarity. Furthermore, we rigorously audit the "job cushion" — ensuring the project is projected to create significantly more jobs than the minimum required by USCIS, safeguarding your immigration eligibility.

Category 3

Process & Timeline

Everything you need to know about processing times, Green Card timelines, and eligibility requirements before you invest.

Timelines vary based on USCIS adjudication capacity and the investor's country of origin. However, Motcomb frequently offers access to Rural, TEA and Infrastructure projects, which are all eligible for "Priority Processing" under current legislation. This designation can significantly shorten the adjudication period for the I-526E petition compared to standard EB-5 investments.

Yes. To comply with U.S. securities regulations (Regulation D), Motcomb's private equity investments are generally available only to Accredited Investors. This typically requires a net worth exceeding $1 million (excluding your primary residence) or consistent annual income thresholds. We can help you verify your status during our initial consultation.

Can't find an answer?

Contact us.

What our clients say

We've helped a wide variety of clients navigate the ever-changing landscape of the U.S. EB-5 investment program.

Contact us

Our friendly team would love to hear from you